GST Registration

GST Registrations

Goods and Services Tax (GST) is a comprehensive tax levy that encompasses various indirect taxes like VAT, Service Tax, and Excise Duty. It has replaced the earlier tax system and has been implemented to simplify the indirect taxation process. All businesses with a turnover of more than Rs. 20 lakhs (Rs. 10 lakhs for special category states) must register for GST.

However, small businesses having all India aggregate turnover

below Rupees40 Lakh (in case of exclusive supply of goods) (Rupees 20

lakh if business is in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura and Uttarakhand) and Rupees 20 lakhs (in case of supply of services or in case of mixed supplies) (Rupees 10 lakh if business is in States of Manipur,Mizoram, Nagaland and Tripura) need not register.The small businesses, having turnover below the threshold limit can, however, voluntarily opt to register.

The registration process is simple and can be completed online. In this article, we will discuss the process of GST registration, its advantages, and disadvantages.

Who We Are

“Tax Zone India is committed to providing the best GST registration services to its clients. We are involved in every step of the process, from documentation to filing, to ensure that our clients receive top-quality services at the best prices. We welcome both positive and negative feedback as it helps us identify areas for improvement and move forward with better services. We strive to provide the best services and our client’s satisfaction is our top priority. At Tax Zone India, we believe in transparency and reliability and ensure that there are no other concerns for our clients other than receiving the best service from us.”

Documents requires

- Pan Card

- Aadhar Card

- Passport size photo

- Aadhar linked mobile number

- Trade name

- Other registration certificate in case of selling food products or madicine

- Other docs (Basis on service requires)

- Address proof of principle place of business like Rental Agreement/property tax electricity bill/NOC/Both with owner ship documents

Process of GST Registration

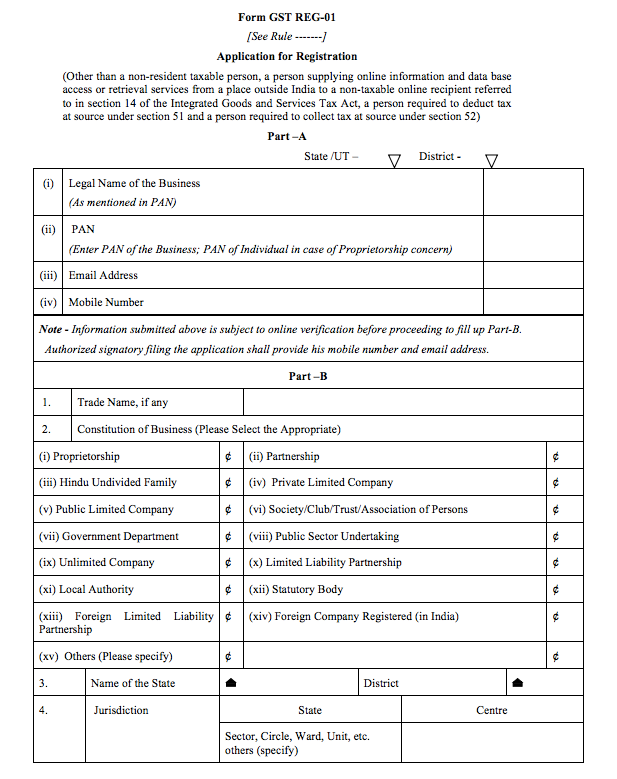

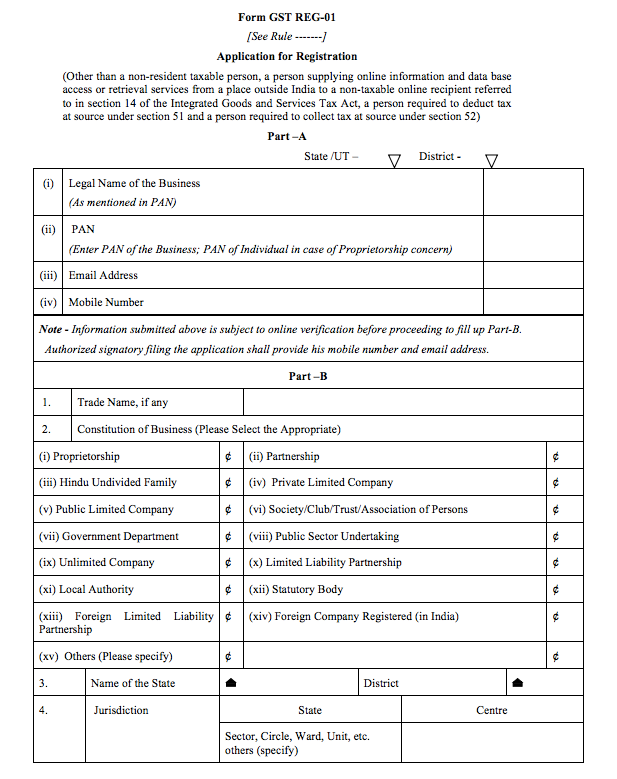

GST registration can be done online on the GST portal by filling in the GST registration form. The process can be broken down into the following steps:

Login to GST Portal – The applicant must first create an account on the GST portal with a valid email ID and mobile number.

Fill the GST Registration Form – The applicant must fill in the GST registration form with relevant information like the name of the business, PAN number, and address.

Upload Documents – The applicant must upload supporting documents like PAN card, address proof, and bank account details.

Verification – The application is verified by the GST department, and if all details are correct, a GSTIN (GST identification number) is issued.

Payment of GST – Once GST registration is complete, the applicant must pay GST on all goods and services sold.

Advantages of GST Registration

Elimination of Cascading Tax – Earlier, the tax paid on inputs was not available as input tax credit. Under GST, input tax credit is available, which eliminates the cascading effect of taxes.

Threshold for Registration is Higher – Under the earlier tax system, businesses with a turnover of more than Rs. 10 lakhs had to register for VAT. Under GST, the threshold for registration is Rs. 20 lakhs, which eases the compliance burden on small businesses.

Composition Scheme for Small Businesses – Small businesses with a turnover of less than Rs. 1.5 crores can opt for the composition scheme, which allows them to pay a lower tax rate and reduces the compliance burden.

Improved Efficiency of Logistics – GST has eliminated the need for multiple tax checkpoints, which has led to faster movement of goods and reduced logistics costs.

Unregistered Sector is Registered in GST – Many small businesses were not registered under the earlier tax system. GST has brought them under the tax net, which has increased the tax base.

Disadvantages of GST Registration

Increase in Operation Cost – GST has increased the cost of compliance for businesses. Businesses must file returns every month, which increases the operational cost.

Existence of Registered and Unregistered Business – Under GST, businesses that are not registered cannot claim input tax credit, which creates a disadvantage for them. This has led to the existence of both registered and unregistered businesses.

Technical Glitches – The GST portal has faced technical glitches and downtime, which has created difficulties for businesses trying to file returns.

Complexity – The GST law is complex, which makes it difficult for small businesses to understand and comply with the regulations.

GST has brought about a significant change in the indirect tax system in India. The registration process is simple, and the advantages of GST registration outweigh the disadvantages. While it has increased the cost of compliance, it has also eliminated the cascading effect of taxes and increased the efficiency of logistics. The government must continue to work towards simplifying the GST law and addressing the technical glitches faced by businesses. Overall, GST is a positive step towards making India a more business-friendly environment.