A Few Words

Good & Service Tax

GST ( GOODS AND SERVICE TAX )

GST is a single tax on the supply of goods and services, from the manufacturer to the consumer. It’s Also Known As Indirect Tax.

The Goods and Services Tax (GST) is a tax on goods and services consumed in India. GST is an indirect tax that has replaced many other indirect taxes in India, such as excise duty, VAT, and services tax. GST has been in force from 1st July, 2017 based on the Goods and Service Tax Act passed by the Indian Parliament on March 29, 2017.

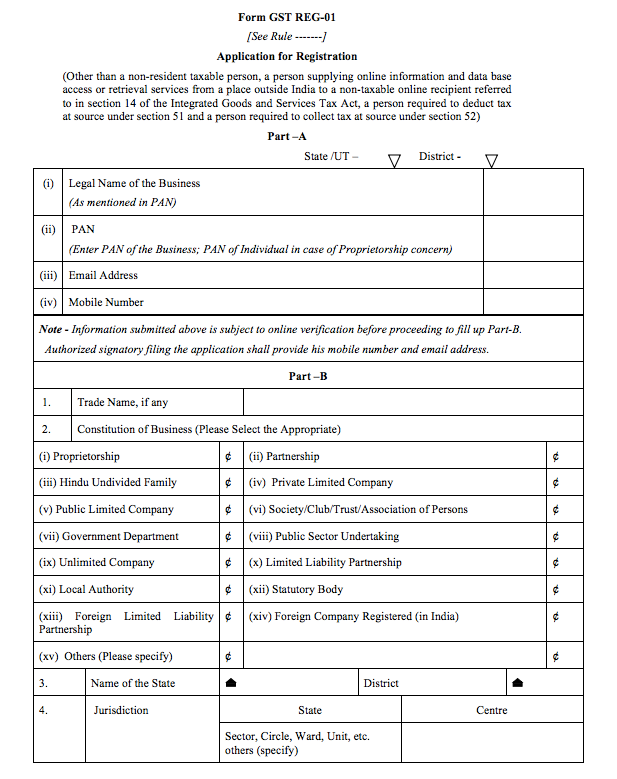

Businesses that are registered under GST have to file the GST returns monthly, quarterly, and annually based on the business. Here it is necessary to provide the details of the sales or purchases of the goods and services along with the tax that is collected and paid. Implementation of a comprehensive Income Tax System like GST in India has ensured that taxpayer services such as registration, returns, and compliance are in range and perfectly aligned.

GST registration can be cancelled voluntarily if the business is dormant or does not have the necessary business turnover. Further, a GST registration can also be cancelled by a GST officer if the business is non-compliant under GST. Once GST registration is cancelled, the person or entity is no longer required to file GST returns and is not required to pay or collect GST.

Implemented in India from 1st July 2017. Over 1.3 crore businesses in India have been registered and issued GST registration under the new GST regime. The entities registered under GST must file annual returns as per the scheduled GST return due date.

GST BENEFITS

Reduction in multiplicity of taxes

Simple Tax System

Common Tax All Over Country.

Types of GST

Central Goods and Services Tax. ( INTRASTATE )

State Goods and Services Tax. ( WITHIN STATE )

Integrated Goods and Services Tax : ( INTER STATE )

GSTIN ( GST IDENTIFICATION NUMBER )

GST number is a 15-digit number That is assigned to every taxpayer at the time of GST registration. Main Uses of GSTIN Are-

It Helps Us to Avail Loan from Bank.

With the Help Of GSTIN, We Can Avail of Refunds