Udyam Registration

UDYAM Registration

UDYAM registration

About this item

- UDYAM Registration

Who We Are

Our team is committed to providing you with the best service when it comes to Udhyam registration. We are involved in the entire process, from understanding your requirements to submitting your application, at a price that is competitive and reasonable compared to the market. We value your feedback, whether it’s positive or negative, and strive to use it constructively to improve our service. There is no other concern like us to give you the best service possible.

Documents requires

- Pan Card

- Aadhar Card

Talk To Our Advisor

Udyam Registration

The Micro, Small and Medium Enterprises (MSME) sector is the backbone of the Indian economy, contributing significantly to its growth and development. In order to provide a boost to this sector, the Ministry of Micro, Small and Medium Enterprises (MSME) introduced the Udyam Registration process on July 1, 2020. The Udyam Registration process replaced the earlier Udyog Aadhaar registration process, and it aims to simplify the registration process for MSMEs and provide them with various benefits and advantages. This article will discuss the Udyam Registration process, its benefits, and the revised MSME definition introduced by the government.

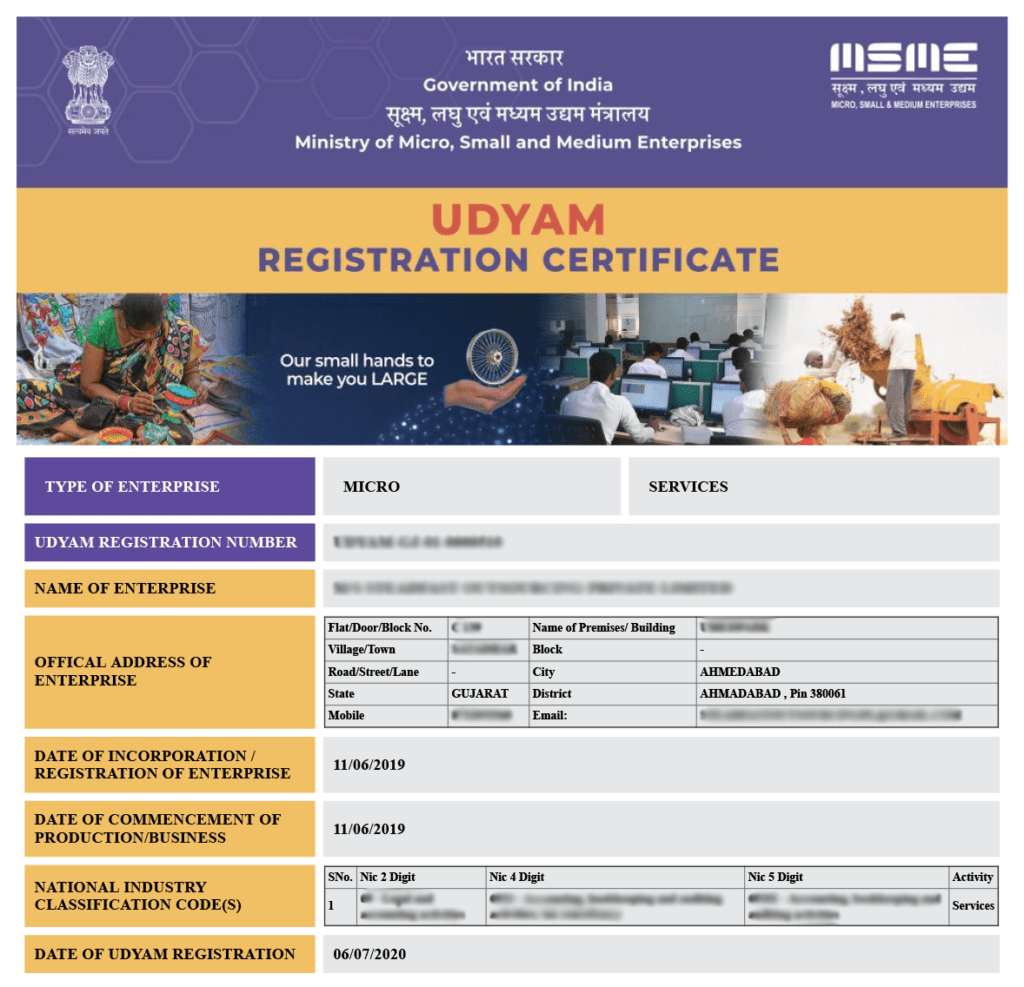

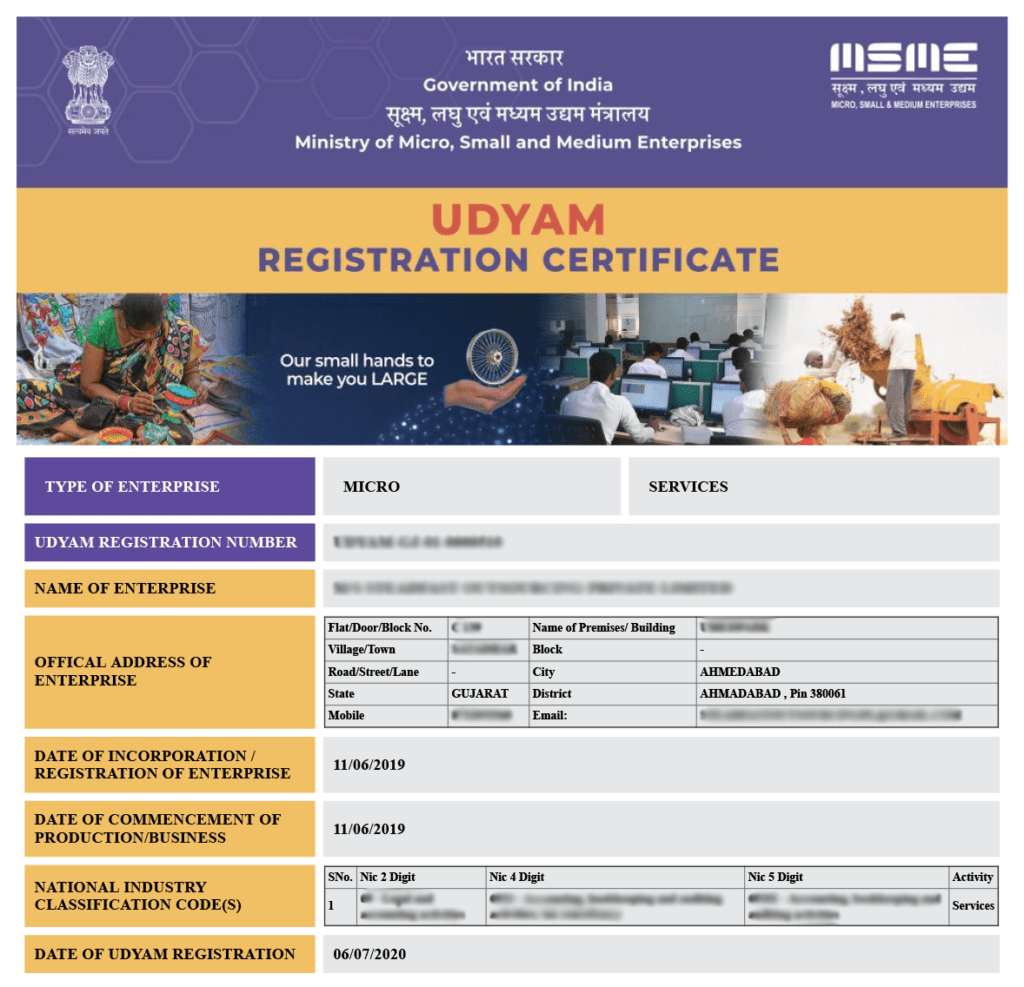

Udyam Registration Process: The Udyam Registration process is a simple online process that can be completed in a few minutes. The process is based on self-declaration, and there is no need to submit any documents, certificates, papers, or proofs. The applicant is required to provide their 12-digit Aadhaar Number, PAN, and bank account details of the business for the registration process. The investment and turnover details of the enterprise will be taken automatically from the government databases linked with PAN and GST numbers. Once the registration process is completed, the enterprise will be assigned a unique permanent identification number known as the Udyam Registration Number. An Udyam Registration Certificate will also be issued to the enterprise, which will contain a dynamic QR Code from which the details about the enterprise can be accessed.

Benefits of Udyam Registration: The Udyam Registration provides various benefits to MSMEs, which includes:

Special Preference in Procuring Government Tender: Enterprises registered under Udyam are given special preference in procuring government tenders, which can help them to increase their business.

Access to Bank Loans without Collateral/ Mortgage: Udyam registration helps to get bank loans without collateral or mortgage, which can help enterprises to expand their business.

1% Exemption on Interest Rate on Bank Overdraft (OD): Enterprises registered under Udyam can avail of a 1% exemption on the interest rate on bank overdrafts, which can help them to reduce their financial burden.

Tax Rebates: Various tax rebates are available for Udyam registered enterprises, which can help them to save money.

Higher Preference for Government License and Certification: Enterprises registered under Udyam are given higher preference for government license and certification, which can help them to expand their business.

Tariff Subsidies and Tax and Capital Subsidies: Registered Udyam enterprises can avail of tariff subsidies and tax and capital subsidies, which can help them to reduce their costs and increase their profits.

Concession in Electricity Bills: Udyam registration provides concession in electricity bills, which can help enterprises to reduce their operating costs.

Protection against Delayed Payments from Buyers: Udyam registration provides protection against delayed payments from buyers, which can help enterprises to maintain their cash flow.

Fast Resolution of Disputes: Udyam registered enterprises can get their disputes resolved faster, which can help them to save time and money.

Special 50% Discount on Government Fees for Trademark and Patent Filing: Udyam registered enterprises can avail of a special 50% discount on government fees for trademark and patent filing, which can help them to protect their intellectual property.

Revised MSME Definition: In the Atmanirbhar Bharat package announced on May 13, 2020, the government revised the MSME definition to bring more units under the purview of the schemes announced. The composite criteria for the definition of MSME are investment and turnover, and the limit has been revised upwards.